To understand a pay stub without guessing, start by examining your gross pay, which shows your total earnings before deductions. Next, review each deduction—taxes, insurance, retirement contributions—to see what’s taken out. Check that the net pay matches what you actually receive. Comparing these figures to your hours worked or pay rate helps spot errors. Keep an eye on details; if you want step-by-step guidance, continue exploring.

Key Takeaways

- Familiarize yourself with common payroll terminology like gross pay, net pay, and deductions before reviewing the stub.

- Start by identifying your gross pay to understand total earnings before deductions.

- Review the deduction breakdown carefully, noting taxes, insurance, and benefit contributions.

- Cross-check figures with your records or timesheets to verify accuracy and catch errors.

- Keep pay stubs secure and regularly review them to ensure all information remains correct and confidential.

What Is a Pay Stub and Why It Matters

Have you ever wondered what exactly a pay stub shows you about your paycheck? A pay stub is a detailed record that breaks down your earnings and deductions using payroll terminology. It’s essential because it helps you understand how much money you actually take home and where it’s going. The pay stub format presents information clearly, typically listing gross pay, taxes, insurance, and other deductions. Knowing what a pay stub reveals allows you to verify your earnings, catch errors, and plan your finances better. It’s more than just a paycheck stub; it’s a financial snapshot that keeps you informed about your income and deductions. Understanding this document helps you stay on top of your financial health and guarantees transparency with your employer.

Understanding the Main Parts of Your Pay Stub

Your pay stub shows your gross pay before taxes and deductions, and your net pay after all deductions are taken out. Understanding the breakdown of deductions helps you see where your money goes each pay period. Let’s look at how gross and net pay differ and what deductions are included. Additionally, familiarizing yourself with vetted payroll terms can help you better interpret your pay stub details. Recognizing the importance of accurate contrast ratio in visual displays can also be useful when reviewing detailed breakdowns or visual representations on your pay stub. Being aware of Free Floating concepts can help you understand how some deductions or benefits are calculated without fixed reference points, providing a clearer picture of your overall compensation. Understanding how wave and wind can impact payroll processing, especially in remote or offshore work scenarios, can be an important aspect of comprehensive payroll knowledge. Knowing the affiliate disclosure ensures transparency if you’re researching products or services related to payroll or finance.

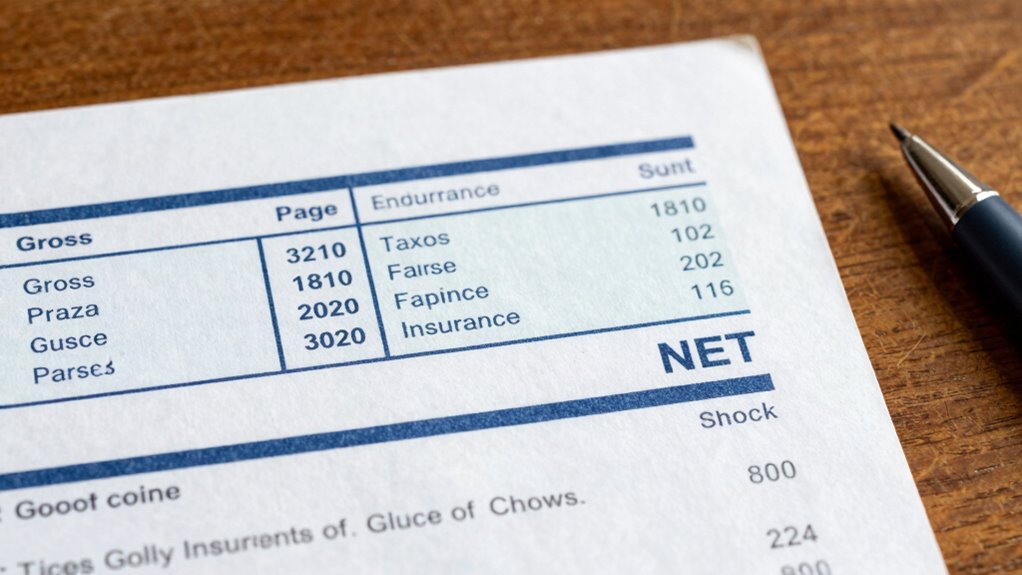

Gross vs. Net Pay

Ever wonder what the difference is between gross pay and net pay on your paycheck? Gross pay is your total earnings before taxes and deductions, while net pay is what you actually receive. Understanding this difference is essential for grasping the tax implications of your income and planning for retirement. Your gross pay helps you see your total earning potential, which influences contributions to retirement accounts and tax brackets. Net pay reflects the amount available for your expenses and savings after mandatory deductions. Recognizing these figures helps you make informed financial decisions and ensures you’re prepared for future financial planning. Always verify both amounts on your pay stub to stay aware of how taxes and other deductions impact your take-home pay. Being aware of pay stub components can improve your financial literacy and aid in budgeting. Differentiating between these amounts is crucial for managing your financial health effectively.

Deduction Breakdown

Understanding the deduction breakdown on your pay stub is key to knowing where your money goes each pay period. This section shows all your deductions, including taxes and benefits. Look for tax codes, which tell you how much is withheld for federal, state, and local taxes. Benefit details explain deductions for health insurance, retirement plans, or other perks. These amounts are subtracted from your gross pay to arrive at your net pay. Knowing this breakdown helps you verify that the correct taxes and benefits are being deducted. If you see unfamiliar entries or unexpected amounts, it’s worth reviewing with your employer or HR department. Being aware of your deduction details ensures you understand how your paycheck is calculated and where your money is allocated. Additionally, understanding the 16PF traits can help you identify personal strengths and areas for growth related to your financial habits and decisions.

How to Verify Your Earnings and Deductions Step-by-Step

Start by checking your earnings details to make certain your hours or salary are correct. Next, review the breakdown of deductions to confirm all amounts are accurate. This step-by-step approach helps you spot errors and understand your pay better. Additionally, understanding your pay stub can help you identify potential safety concerns related to incorrect deductions or unauthorized charges.

Check Earnings Details

How can you be sure that your paycheck is accurate? Start by reviewing the earnings section carefully. Look for regular wages, bonus pay, and overtime hours. Confirm that each amount matches your records or timesheets. Check if your bonus pay is included correctly and if overtime hours are calculated accurately. To visualize, imagine this breakdown:

| Earnings Type | Hours/Amount | Total Pay |

|---|---|---|

| Regular Wage | 40 hours | $600 |

| Bonus Pay | N/A | $50 |

| Overtime Hours | 5 hours | $75 |

| Other Earnings | N/A | $20 |

| Total Earnings | $745 |

This helps verify your earnings quickly and guarantees nothing’s missing or incorrect. Additionally, understanding earnings details can help you identify discrepancies early and ensure you’re paid correctly. Recognizing paystub components can also make it easier to interpret your paycheck and avoid confusion. Being familiar with payroll terminology can further improve your ability to review your paycheck accurately, especially when you understand how different terms relate to your earnings calculations. Moreover, paying attention to deduction details is essential for a comprehensive review of your paycheck.

Review Deduction Breakdown

Have you double-checked your deductions to guarantee they’re accurate? Reviewing your deduction breakdown helps ensure your pay stub reflects correct amounts and avoids surprises during tax season. Look closely at deduction examples like federal taxes, Social Security, Medicare, and any voluntary contributions. Verify that these deductions align with your expected amounts and check for any errors or unauthorized withholdings. Understanding the tax implications of each deduction can help you plan better for upcoming filings. If you notice discrepancies, contact your payroll department promptly. Accurate deduction review also helps you understand how your pay is affected and ensures you’re not overpaying or underpaying taxes. Being proactive in this step safeguards your earnings and clarifies your overall financial picture. Recognizing potential errors early can prevent costly issues later on, especially when considering tax compliance and future audits. Additionally, understanding the impact of cloud service outages can help you prepare contingency plans for unexpected disruptions to your financial processes. Incorporating knowledge about AI detection methods can also aid in identifying inaccuracies or fraudulent activity on your pay stub. Regularly reviewing your pay stub is a crucial part of managing your overall financial health.

Common Pay Stub Mistakes and How to Spot Them

Mistakes on pay stubs can easily go unnoticed if you’re not paying close attention. One common issue is misinterpreting pay stub terminology, which can lead you to overlook errors in gross pay, taxes, or deductions. For example, confusing taxable income with net pay might cause you to miss incorrect withholding amounts. Understanding payroll terminology can significantly improve your ability to catch errors early, especially when you know how each item is calculated and reported. Accurate pay stub details are essential for verifying that your earnings and deductions are correct. A clear understanding of pay stub components helps you distinguish between what you earned and what was deducted, making it easier to spot discrepancies. Familiarity with payroll records can also help you cross-check your pay stub against your actual work hours and pay rate. Common payroll errors include incorrect hours worked, wrong tax codes, or missing overtime pay. To spot these mistakes, compare your pay stub details with your records—such as timesheets and tax documents. Always verify that your hours, pay rate, and deductions match your expectations. Being familiar with pay stub terminology helps you quickly identify discrepancies. Pay stub accuracy is crucial for ensuring you are paid correctly and can address issues promptly with your employer.

Easy Tips to Use Your Pay Stub for Better Money Management

Ever wondered how your pay stub can be a powerful tool for managing your finances? By reviewing it regularly, you can identify opportunities for better tax planning and optimize retirement contributions. Use your pay stub to track your gross income and deductions, ensuring they align with your financial goals. Here’s a quick tip:

| Income Category | Amount |

|---|---|

| Regular wages | $X,XXX |

| Overtime, bonuses | $XXX |

| Deductions | $XXX |

| Retirement contributions | $XXX |

| Taxes | $XXX |

This table helps you see where your money goes and where you can make adjustments. For example, increasing retirement contributions can reduce taxable income, saving you money on taxes now and building your future.

How and When to Fix Errors on Your Pay Stub

Regularly reviewing your pay stub not only helps you manage your finances but also guarantees all details are correct. If you spot errors, it’s essential to act promptly to protect pay stub security and maintain pay stub confidentiality. Contact your HR department or payroll provider as soon as possible, providing clear details about the mistake. Keep copies of your pay stub and any correspondence for record-keeping. Fixing errors early prevents potential issues like incorrect tax filings or underpayment. Always verify your pay stub information is accurate before sharing or storing it securely. Remember, safeguarding pay stub confidentiality means avoiding unnecessary sharing of sensitive info. Regular checks and swift action help you stay on top of your earnings and protect your financial privacy.

Frequently Asked Questions

How Often Should I Review My Pay Stub for Accuracy?

You should review your pay stub each pay period to guarantee accuracy. Regular checks help you spot errors in payroll deductions and confirm tax compliance. By reviewing your pay stub consistently, you can catch mistakes early, verify your hours worked, and ensure your earnings are correct. This habit helps protect your income and ensures your employer’s payroll process remains accurate and transparent, giving you peace of mind.

What Should I Do if I Notice a Mistake on My Pay Stub?

Did you know that 1 in 10 employees find errors on their pay stubs? If you notice pay stub discrepancies, act immediately. Contact your HR or payroll department for wage verification and provide documentation if needed. Keep records of your pay stubs and communication. Addressing mistakes promptly guarantees you’re paid correctly and helps prevent future errors, protecting your earnings and peace of mind.

Are There Specific Terms I Should Understand Better on My Pay Stub?

You should familiarize yourself with key pay stub terminology like gross pay, net pay, deductions, and taxable wages. Understanding wage components such as overtime, bonuses, and taxes helps you verify your paycheck accuracy. Pay attention to how these terms are listed and calculated, so you can spot any discrepancies. Knowing these details empowers you to manage your finances better and ask informed questions if something seems off.

How Can I Compare Pay Stubs From Different Pay Periods Effectively?

To compare pay stubs from different pay periods effectively, focus on pay stub terminology and payroll deduction explanations. Look at your gross pay, net pay, and any changes in deductions or hours worked. Check for consistent entries like hourly rate or salary, and note any variations in taxes or benefits. This approach helps you understand income fluctuations and guarantees your pay is accurate across periods.

What Records Should I Keep Alongside My Pay Stubs?

Back in the day, people kept everything in shoeboxes, and you should do the same with your records. Keep your pay stubs alongside tax documents and benefit records. These help verify income, track deductions, and make sure accuracy when filing taxes or reviewing your financial health. Organize them in a folder or digital file, so when questions arise or audits happen, you’ll have everything ready and easy to find.

Conclusion

Now that you know how to read your pay stub, you have the key to revealing your financial picture. Think of it as a map guiding your money journey—clarifying your earnings, deductions, and potential errors. With this knowledge, you’re empowered to steer your finances confidently and avoid surprises. Remember, your pay stub is your financial compass—use it wisely, and let it lead you toward smarter money management every step of the way.